You can support the FGS when you fill your tax return.

Go to Portal das Finanças and…

- click on “Comunicar Entidade a Consignar”;

- find “Fundação Gonçalo da Silveira” with the NIF 507 002 130;

- click on “submeter”.

Consigning 0.5% of your tax return means you can choose to which charitable organization the State will assign 0.5% of the tax you paid that year, at no extra cost to you. The donation is subtracted from the total tax, and does not affect any refunds due to you from the Treasury.

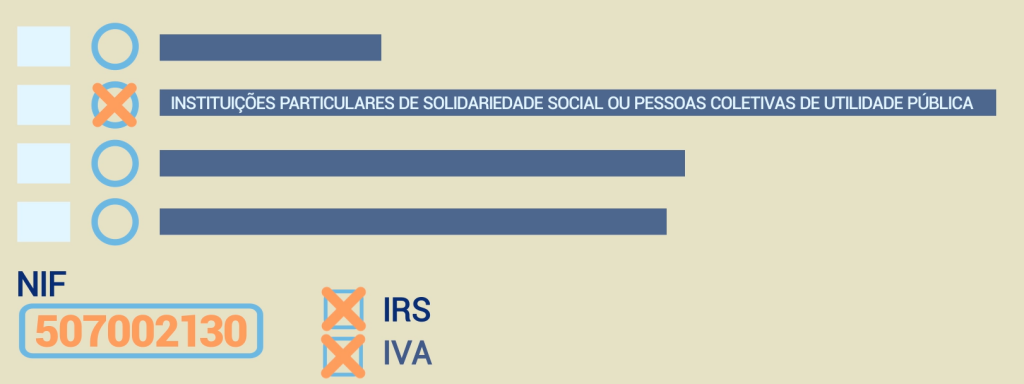

You can also support the FGS by deducting 15% of the VAT supported by you (just check the relevant box). However, in this case you are waiving any refund you are due, handing it instead as a donation to our institution. The amount is derived from VAT paid on all your car repair, hairdresser and restaurant/hotel invoices, as provided for in no. 1 of art. 78-F of the IRS Code).

How to fill the tax return form?

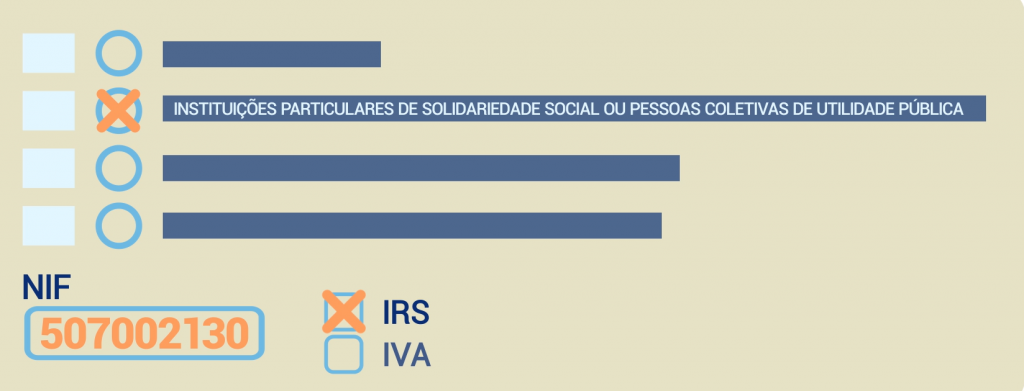

To support the Fundação Gonçalo da Silveira, all you need to do is fill box 1101, Table 11, Form 3, selecting “Instituições Particulares de Solidariedade Social or Pessoas Coletivas de Utilidade Pública (Private Charities or Public Benefit Entities) (para. 6, art. 32.º of Law 16/2001, June 22nd)”. Fill in with our tax number, NIF 507 002 130 and finally check “IRS” (and “IVA” if you so wish).

What does the assignment of 0,5% of my Tax Return (IRS) mean?

As a rule, taxes are used to fund State spending without our having a direct decision on how they are used. This assignment of 0,5% of your Tax Return is an exception. It comes at no cost to you, and allows you to choose to where the State will direct 0.5% of the total tax you paid during the year!

What does it mean to assign 15% of the VAT you paid?

Using the 15% tax benefit from VAT paid by you is a new possibility of supporting non-profit organizations. By opting for this, you are waiving a refund automatically due to you in favour of passing it as a donation to an accredited institution. This VAT value, as indicated above, is derived from any invoices you paid in car repair shops, hairdressers and restaurants/hotels (as provided for in no. 1 of art. 78-F of the IRS Code).

How do we use your donations?

Donations received are a significant source of income for the FGS, enabling us to implement our projects in Education, Training, Global Citizenship and Development, which are key to ensuring equity, solidarity and social transformation.

Click below to watch the Campaign video with audio.

Saiba mais sobre os nossos projetos através dos nossos Relatórios e Contas, Relatórios de Atividade ou subscrevendo a nossa Newsletter.